When we read about the Asia-Pacific Economic Cooperation (APEC) summits, the headlines are dominated by photos of world leaders in matching shirts, high-stakes trade wars, and complex geopolitical discussions. We often dismiss these gatherings as high-altitude diplomacy that has little to do with our daily lives in Kuala Lumpur, Petaling Jaya, or Penang. In other words, the policies and discussions that take centre stage in APEC Summits feel so distant and disconnected from the everyday Malaysians.

However, beneath the surface of tariff discussions and supply chain logistics in APEC Summits lies a critical agenda that affects every single Malaysian worker: Human Capital Development.

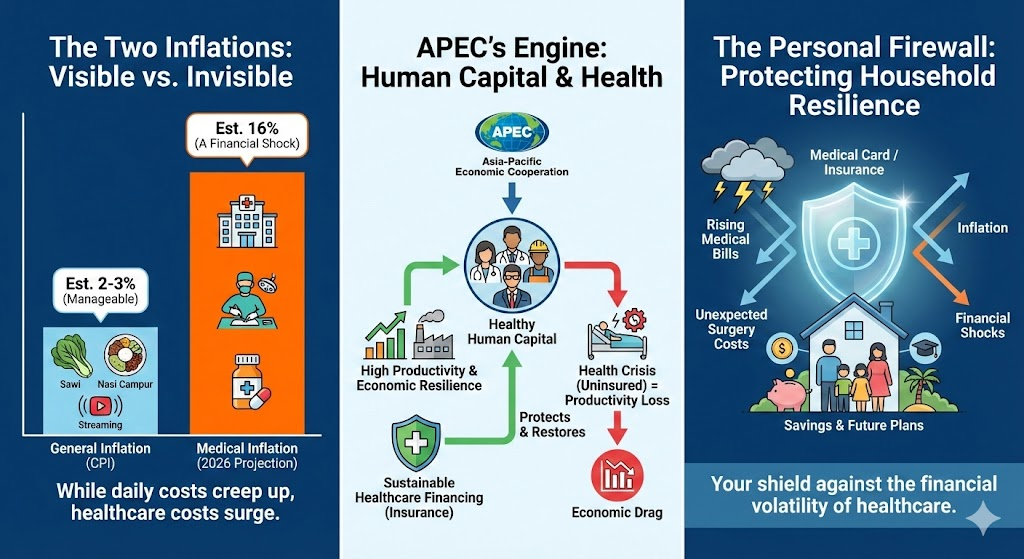

For the first time in decades, global economic superpowers are realizing that trade agreements are useless if the workforce is too sick to be productive or too financially fragile to take risks. This means that national economic resilience starts at the household level, and the latest APEC discussions have put great emphasis on sustainable healthcare financing.

The Global Shift: Health is the New Wealth

Because a healthy workforce is a productive workforce.

Historically, economists and policymakers alike viewed healthcare as a cost—a drain on the national budget. But the narrative at recent APEC summits, including the 2024 Leaders’ Declaration, has shifted dramatically. Health is now viewed as a “strategic asset.” A healthy society is a productive society, which easily translates into economic development and value creation.

This is not difficult to understand. APEC’s Human Resources Development Working Group has increasingly focused on the concept of “Health-Related Productivity Loss.” When you fall sick, you need time to recover before you’re able to return to the workforce. When you’re recovering from the disease, the productivity of the economy is affected. When a skilled knowledge worker is sidelined by a treatable condition—waiting months in a queue for surgery (this is actually happening in Malaysia – treatable conditions that require surgery treatments have several months of waiting list) —Malaysia’s economy easily loses tens of thousands of Ringgit in productivity.

With the rising costs of living in Malaysia, the retirement age has also been increased multiple times from age 55 to 60 today, and the government of Malaysia is considering raising the retirement age to 65 years old. This also means that the workforce of Malaysia, like in advanced economies of the world, is aging more rapidly because more and more people are staying in the workforce longer and delaying retirement. With old age comes not only experience and knowledge, but also certain health risks. They come hand in hand and there’s no way to mitigate or avoid this. Older people are naturally more vulnerable to certain health problems/conditions/diseases.

This problem is also not just affecting only Malaysia. APEC member nations are dealing with aging populations across the board and the high occurrences of non-communicable diseases such as diabetes, hypertension and obesity, which translate to a huge loss to the economy. To try and deal with this, APEC nations are embracing the concept of Sustainable Healthcare Financing.

As early as the year 2014, multiple studies have shown that aging and non-communicable diseases or NCDs cause losses in GDP. An aging workforce coupled with high prevalence of NCD’s can pose huge risks and vulnerability to the productivity of the nation. A healthy workforce is a productive workforce – this is one of the major reasons why APEC countries are trying hard to solve healthcare cost problems so that access to quality treatments by the workforce is made possible at all times.

(Aging workforce & high NCDs = higher chance for workers to fall ill, generally speaking, taking them out of the rotation in the global economy machine. Quick access to healthcare restores ill workers faster and allow them to rejoin the workforce sooner)

The consensus is that the currently overstretched public healthcare systems in Malaysia alone cannot bear this burden. To maintain economic momentum, nations need a “mixed” financing model where private insurance plays an important yet robust role in absorbing shocks and manage gaps in the healthcare system, and allow for the people to gain access to private healthcare without being burdened by astronomical hospital bills.

The Medical Inflation Crisis

Over the past few years, we’ve witnessed the massive rise of prices of everyday goods such across the board from chicken, salmon, avocado to petrol costs:

Vegetables

- Due to severe monsoon seasons and supply chain disruptions, prices for common greens spiked violently in late 2025.

- Mustard Greens (Sawi): Jumped from RM3.00/kg to RM7.00/kg.

- Red Chillies: Soared from RM14.00/kg to RM25.00/kg in some wet markets.

- French Beans: An extreme case, rising from RM4.00/kg to RM14.00/kg during peak shortage.

Eggs (Post-Subsidy Removal):

- Following the full removal of egg subsidies (August 2025), prices floated to market rates.

- Quality eggs have almost increased 50 percent in prices.

- Grade A/B/C Eggs: Saw an immediate average hike of 3–5 sen per egg.

- While small per unit, for a family consuming a tray (30 eggs) a week, this adds up to a noticeable monthly increase, especially when combined with other grocery hikes.

Dining Out (The Service Tax Knock-on):

- “Food Away From Home” inflation has consistently outpaced “Food At Home” inflation (hovering around 3.5% – 4.5% increase year-on-year).

- Example: A standard plate of mixed rice that used to cost RM7-RM8 pre-covid is now commonly RM13-RM18 in urban centers like KL and PJ.

The above is just a small sample of items that have increased in prices over the years. These price increases eat into our monthly disposable income.

Another form of inflation is actually lurking behind the scenes for the past few years since 2020 that caught everyone by surprise. In the beginning of the year 2024, many major insurers have announced a massive repricing exercise on their policyholders. The reason for this, they say is because of uncontrollable medical inflation in Malaysia.

Medical inflation in Malaysia is currently estimated at around 15% per annum, far ahead of the general inflation rate and even the global average of less than 10%. There are multiple factors that bring up the cost of access to medical treatments at private hospitals in Malaysia, from higher operating costs due to increase of wages to the expensive lab grade equipments that hospitals use. There are also reports of abuse by medical card policyholders to get treatments for minor illnesses.

For the government, this is a budgetary nightmare. But for the individual, it is a ticking time bomb. A procedure that cost RM40,000 five years ago could easily approach RM70,000 today. At a rise of 15% per year, medical treatments can cost two times as expensive every 5 years. This reality forces a difficult conversation about “sustainability”—a buzzword at APEC that applies just as urgently to your bank account as it does to the national deficit.

Bridging the Gap: From National Policy to Personal Security

This is where the macro-economics of APEC crash into the micro-economics of the Malaysian household.

APEC wants to improve world trade and the economy of its members, but they have correctly identified that developing human capital is the key. Human capital—knowledge workers, SMEs, and professionals—contributes the bulk of value to the modern economy. Sustainable healthcare financing can improve the financial resilience of these workers, allowing them to recover quickly from medical setbacks and return to the workforce so that productivity can be maintained.

In this context, private medical insurance is not just a product; it is a tool for managing “health security.” Malaysia has a huge problem in managing healthcare costs with surging medical inflation, and reliance solely on the public healthcare is becoming increasingly unsustainable for those who need speed, comfort, quality and options. (The public healthcare systems are already highly congested, with many wards operating at full capacities (the public healthcare sector is estimated to be short of 10,798 specialist doctors.). The general take from the public is that attentive medical care from public healthcare professionals is simply not possible. )

The Sustainability Pivot

Recent discussions within APEC on ‘sustainable health financing’ mirror the current shifts we see locally, such as the move towards co-payment medical cards and repricing structures.

Just as APEC economies strive to balance budgets to remain competitive, Malaysian families must now review their medical coverage to ensure it remains sustainable. A robust medical card is no longer just a ‘good-to-have’, but very much essential to ensure financial resilience in the face of potential illnesses; it is the personal equivalent of a trade agreement—a necessary buffer against the volatility of rising healthcare costs that ensures one’s personal economy doesn’t collapse during a health crisis.

This leads us to a crucial realization: Most Malaysian households are just one disease away from total financial collapse. Getting complete yet not burdensome medical insurance coverage, therefore, is more important than ever.

If a family is wiped out financially by a single heart attack (which can cost RM100,000 to treat at a private healthcare institution), that is a failure of economic resilience. When thousands of families face this simultaneously, it becomes a national recession.

Understanding the “Co-Payment” Shift

Many Malaysians were caught off guard by recent regulatory moves encouraging “co-payment” or “co-takaful” options. In these plans, the policyholder pays a small percentage of the bill (or a flat deductible) in exchange for lower monthly premiums.

Critics see this as a dilution of benefits. However, viewed through the lens of APEC’s sustainability agenda, it is a necessary step in the right direction.

- Cost Control: It discourages “abuse” of medical services (for example: admitting oneself for a minor fever just to claim insurance, which to be honest, happens more often than not), which hogs medical resources and drives up inflation for everyone.

- Access: By lowering premiums, it keeps insurance accessible to the younger workforce and B40 households who might otherwise drop out of the pool entirely. (They are simply just priced out of a good medical coverage.)

This “shared responsibility” model is exactly what APEC health working groups have advocated for to prevent the collapse of private insurance markets. It ensures that the pool of funds remains healthy enough to pay for the catastrophic claims—the cancer treatments and bypass surgeries—that truly threaten a family’s financial wellbeing.

The “Return to Work” Metric

Let’s reframe the value of a medical card not in terms of “claims paid” but in terms of “time saved.”

In the high-paced APEC economy, time is the most valuable currency.

- Scenario A (Public Route): A knowledge worker suffers a torn ligament. The cost is low (subsidized), but the wait for an MRI and subsequent elective surgery could be 6 to 9 months. That is nearly a year of reduced mobility, lower productivity, and missed opportunities.

- Scenario B (Private Route): The same worker uses a medical card. Diagnosis happens on Monday; surgery happens on Thursday; rehab starts the following week. They are back to full productivity in two months.

For the “Human Capital” agenda, Scenario B is the only acceptable outcome. The medical card buys you speed. And in the modern economy, speed is the difference between keeping your career trajectory or falling behind.

As Malaysia gears up for its future roles in APEC and continues to court foreign investment, the government will continue to focus on big-picture structural reforms. They will build the hospitals, train the doctors, and write the regulations. But the final mile of this economic infrastructure relies on you.

We must stop viewing medical insurance as a “grudge purchase”—something we buy only because we fear sickness. Instead, we should view it as an investment in our own “human capital.” It is the contract that ensures your skills, your experience, and your ability to earn an income are protected from the random shocks of biology. This is also one of the reason why the Malaysian government is coming up with its own basic medical insurance product that guarantees quality healthcare access to everyone, regardless of income levels.

The leaders at APEC are working to inflation-proof the region. You need to shock-proof your life. In a world of rising costs and economic uncertainty, a sustainable, well-structured medical card is the most important trade deal you will ever sign.